Both the City of Vancouver and Surrey recently proposed their budgets for 2021. What caught our eyes were the property tax hike for the upcoming year. This year was a difficult year for everyone due to COVID. When the situation is not under control, amid a second lockdown, at a time when we still need assistance, the government proposed a higher percentage tax hike when the property prices are falling substantially.

The City of Surrey proposed a 2.9% increase in property taxes and an additional $200 increase in Capital Parcel Tax on every residential property. The property tax aligns to what was planned last year and the Capital Parcel Tax tripled because the existing rate is $100. It will generate an additional $20.5 million dollars for the city’s operational fund. It was part of City of Surrey’s five-year capital plan. Major spending next year will be focused on new recreational infrastructure: Newton Community centre, City Centre Sports Complex, and Bear Creek Park Athletics Centre.

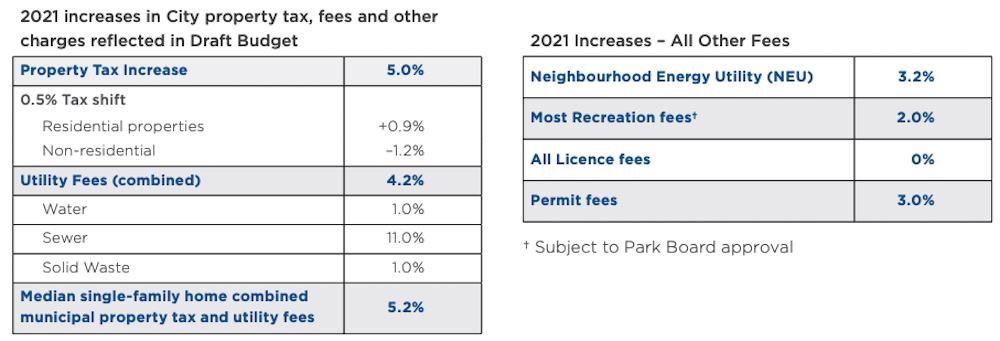

The City of Vancouver on the other hand proposes a 5% increase in property taxes accounting for the tax shift of 0.5% property tax share from non-residential to residential. The property tax portion will generation an additional 51.57 million dollars. It balances out the lost in revenue from other sources.

The debate resolves around rather it is appropriate to increase property tax at this given time. We understand the government has its budget and plans for growth and development. It needs to balance the budget accordingly. The amount of subsidy given out to date must come out of somewhere. When the number of Covid cases are growing rapidly and more deaths being reported everyday, increasing property taxes might not be a good idea. The proposal was based on assumptions that the COVID situation will come to an end in 2021 which nobody can guarantee when and how.

Property taxes were usually related to land and building assessment. The more valuable the land and building, the higher the tax is at a given rate. Real Estate prices are down substantially this year for various reasons. The increase in property tax might not generate the additional revenue as expected unless the City do not adjust property assessment number accordingly. This appears to be another transferring of wealth from the rich to the poor. Are all people who own a residential property achieved financial freedom? No, of course not.

If the money generated from the additional tax revenue are spent toward recreational infrastructure, the construction should be delayed for number of reasons. Completion of these large gathering buildings cannot be used unless COVID is over, question will rise regarding governmental spending, causing more harm to residents to meet unnecessary needs amid a crisis.

Tax should be collected and spent appropriately according to the existing situation. How to collect tax and where to collect from is another problem the Cities in British Columbia must think carefully.