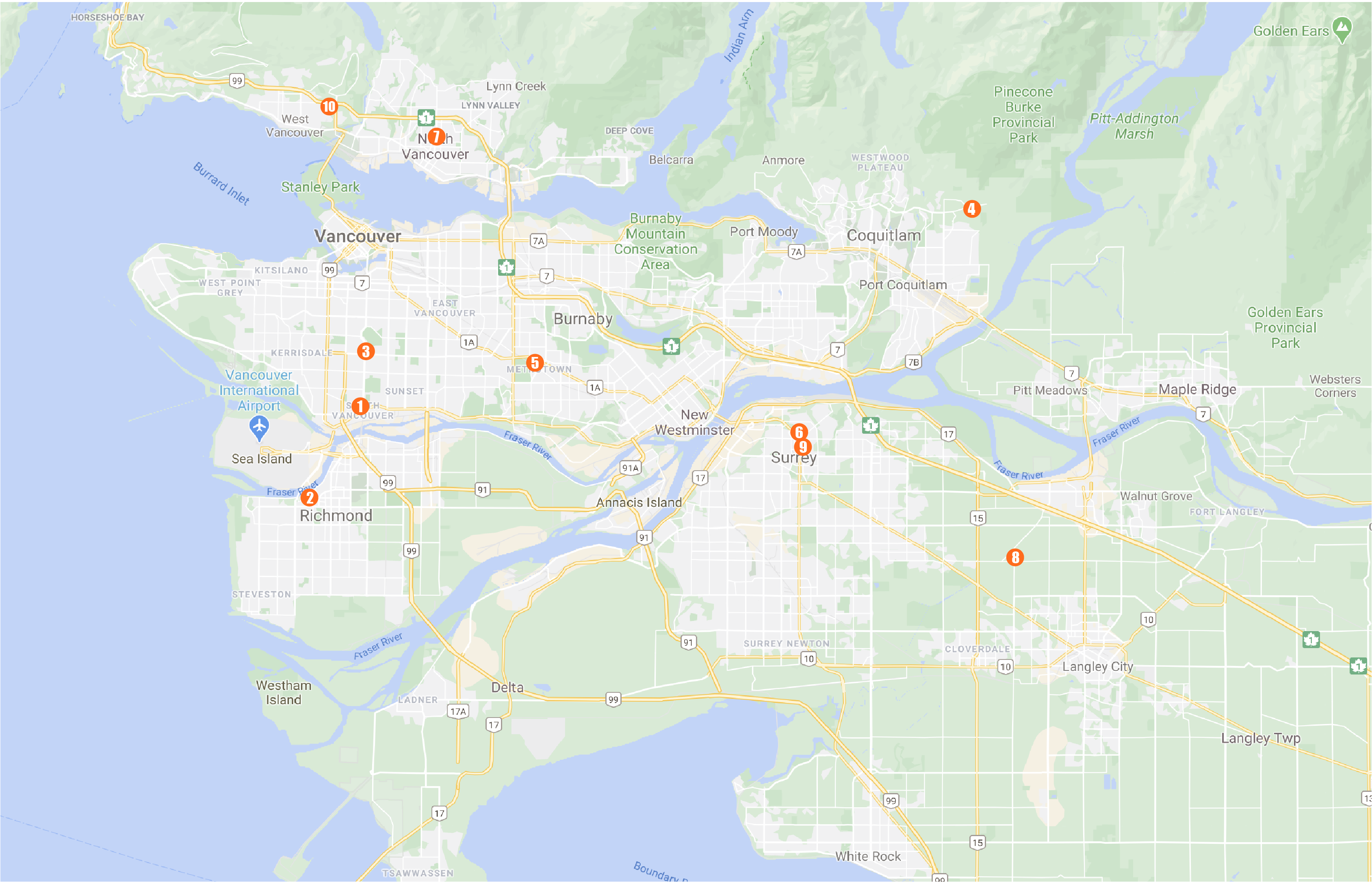

Top 10 Residential Redevelopment Land Deal of 2020

Claridge Real Estate Advisors has been sharing important land transactions and rezoning applications to its clients throughout the past years. We noticed a continued decline in residential redevelopment land related deals throughout 2019 and 2020. 2019 was the year when the real estate industry cooldown and 2020 has reduced market activity due to the pandemic.

Redevelopment land transactions have peaked in Greater Vancouver between 2016-2018 due to the release of multiple official community plans and a hot residential pre-sale market. Most of the land in the OCP was already snatched up by developers and investors, which also contributed to the decline in 2019-2020.

However, Vancouver continues to be a highly desired location and destination. The market demand will continue to rise along with housing supply. We are still far from reaching the equilibrium. We expect the real estate market to grow unless external factors such as government policy changes try to control the market.

Here are the top 10 redevelopment land transactions of 2020 based on transaction value:

No 1. 622-688 SW Marine Drive, Vancouver

- Potential Development: Two towers at 28 and 32 storeys on top of two 6-storey podiums separated with a mid-block break.

- Price: $68,137,600

- Lot Size: 66,473 Sq.ft

- Land Price/Sq.ft: $1,025

- Price/ Buildable Sq.ft: $142

- FSR: 6.68

- Vendor: Private Investor

- Purchaser: Chard Development, https://charddevelopment.com

Topping the chart this year is 622-688 SW Marine Drive with a transaction price of $64 million dollars. The site was initially designated for industrial use like other land along SW Marine Drive. The marine landing review policy changed the mission of the area to transform the area into an employment hub. Chard development saw the opportunity and submitted a development proposal for two towers at 28 and 32 storeys on top of two 6-storey podiums separated with a mid block break. It would have a total of 573 market rental units. 35% of below-market rental floor space provided as social housing operated by YWCA. The site is currently occupied by three commercial buildings with holding income: Denny’s restaurant, a real estate presentation center and two storey office building. By having a new policy in place, the developer would be able to achieve a higher density compared to the original Marpole Community Plan. $1,025 per land foot would be a good bargain for the developer.

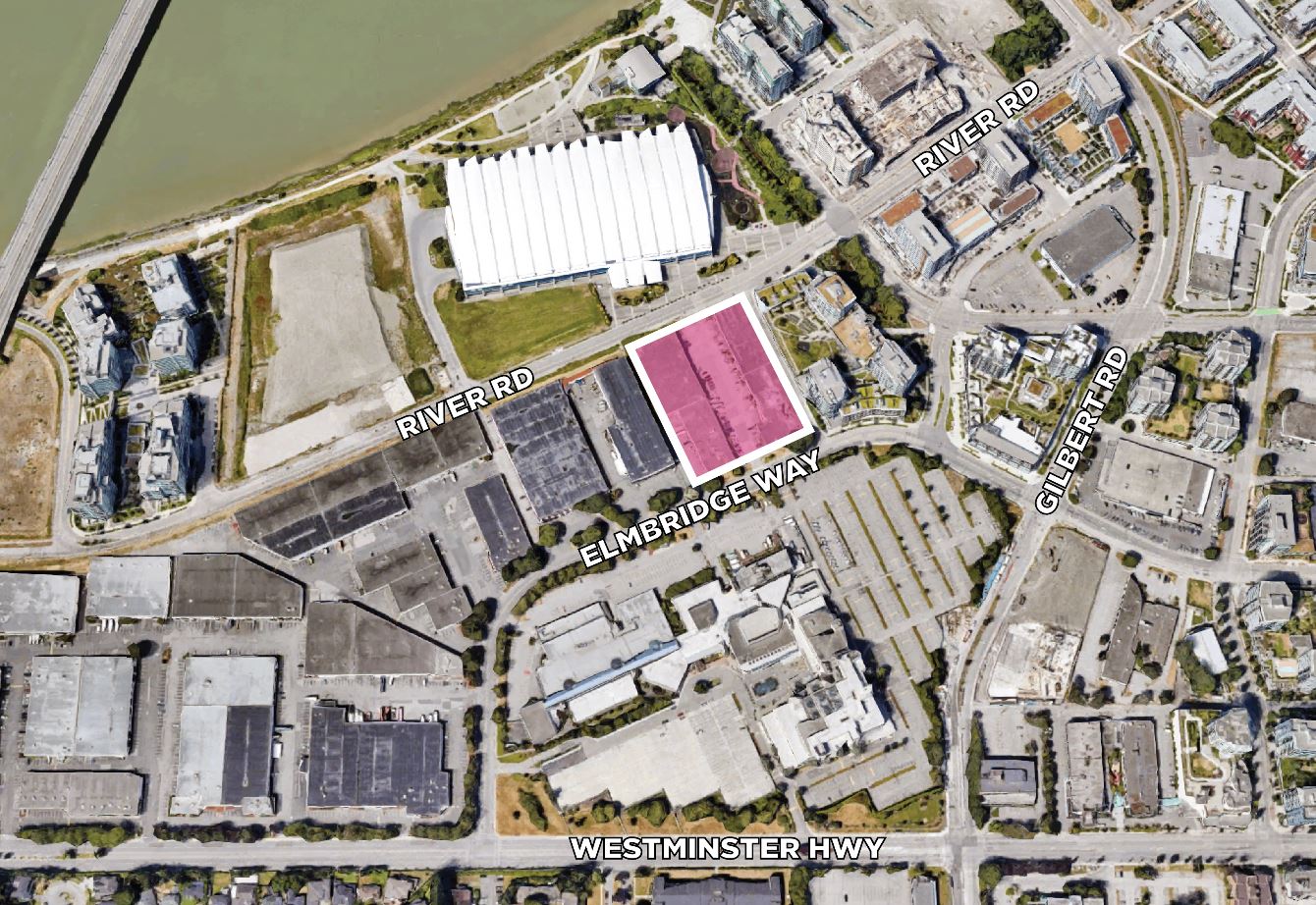

No 2. 6851-6871 Elmbridge Way, Richmond

- Potential Development: Up to 16-storeys mixed-use development including hotel, retail, commercial, parks and public space.

- Price: $60,000,000

- Lot Size: 149,672 Sq.ft

- Land Price/Sq.ft: $401

- FSR: 2.0

- Price/ Buildable Sq.ft: $200

- Vendor: Bene Development, https://www.benehomes.com/

- Purchaser: Landa Global, https://www.landaglobal.com/

Richmond makes second place this year with a transaction price of $60 million dollars for two industrial buildings purchased by Landa Global from Bene Development. Located near the Olympic Oval, the neighbourhood is known for their high-end condo projects. There are multiple projects under construction in the vicinity. It has access to great recreational activity and close to Richmond Center. It is priced at $401/sq.ft, high by today’s standard. However, the site is development permit ready, saved a lot of soft cost, and reduced the time it required to get the project started. The size of the land also adds to the price. The existing 13 commercial rental units for rental will help developers offset some of the holding cost. Bene has purchased the site for $31,300,000 in 2014.

It is not just the size of the site that led to its transaction price, but also the development proposal for three 13 to 16 storey towers submitted to the City of Richmond. It encompasses 304 residential unit, retail, office, and hotel spaces. The project is currently being considered under Richmond OCP Urban Centre T5 within the Oval Village and City Centre Area plan. This is a big project at a prime location in Richmond.

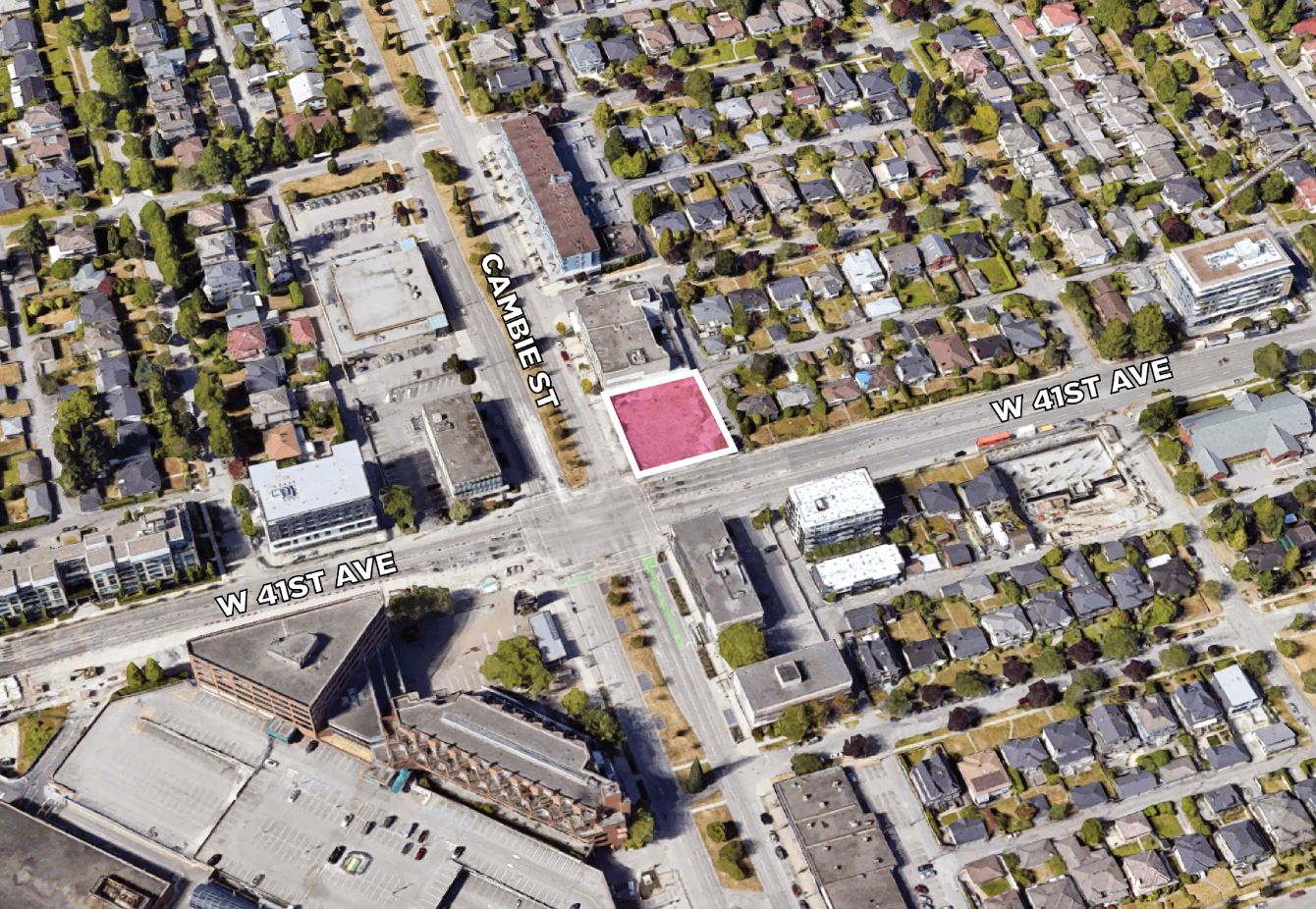

No 3. 495 West 41st Avenue, Vancouver

- Potential Development: Up to 20 storeys high density tower

- Price: $40,000,000

- Lot Size: 15,812 Sq.ft

- Land Price/Sq.ft: $2,530

- FSR: TBD

- Vendor: Coromandel Properties, http://coromandelproperties.com/

- Purchaser: PCI Group, https://pci-group.com/ TD bank, https://www.td.com/

495 West 41st avenue is one of the prized sites Claridge Real Estate Advisors had helped Coromandel Properties acquire for $15,800,000 in 2014. Today, it was sold to PCI Group for $40,000,000 at a premium of $2,530 per land foot. There is no rezoning application submitted at this point. The site is extremely valuable because it is immediately across from future Oakridge Town Center. The City of Vancouver has a very specific development guideline requirement for the four corners at w 41st and Cambie.

No 4. 1331-1340 Olmsted Street, Coquitlam

- Potential Development: Townhomes/Low Density Development

- Price: $39,320,565

- Lot Size: 415,475 Sq.ft

- Land Price/Sq.ft: $95

- FAR: 0.77

- Price/ Buildable Sq.ft: $122

- Vendor: City of Coquitlam, https://www.coquitlam.ca/

- Purchaser: Mosaic Homes, https://mosaichomes.com/

1331-1340 Olmsted street are two large parcels of vacant land located East of the newly established Riley Park (Coquitlam). Mosaic Homes purchased the 415,475 sq.ft site including its development application (20-032 & 20-033, https://www.coquitlam.ca/229/Current-Development-Building-Permit-Appl)to build 167 two to three storeys townhouse units. Surrounding areas are townhouse communities. With a driving distance to Coquitlam Center of 10 minutes, It would be an attractive option.

When the government announced Coquitlam’s Skytrain extension, we are seeing a trend of expansions outside Vancouver core areas. Burke Mountain, further east of Coquitlam center, is coming up with these enormous communities that we would not have expected many years ago. The estimated finished products would sell at approximately $520/sq.ft. One of the projects that went on sale nearby is 3535 Princeton, Coquitlam. The average price was $466/sq.ft.

No 5. 6031 Wilson Avenue, Burnaby

- Potential Development: High Density

- Price: $35,500,000

- Lot Size: 58,414 Sq.ft

- Land Price/Sq.ft: $608

- FAR: 4.5

- Price/Buildable Sq.ft: $135 (base marketable density)

- Vendor: Private Investor

- Purchaser: Bosa Properties, https://bosaproperties.com/

The existing improvement is a three-storey rental building located between Patterson and Metrotown neighbourhood. Bosa Properties had also acquired 5977 and 5979 Wilson Avenue properties nearby. Metrotown is going through rapid densification according to the Metrotown Downtown Plan. Patterson neighbourhood up till Central park and Kingsway is part of this OCP. The guidelines designate the site for High Density Residential Use with a maximum FAR of 8.3 including bonus density. Since there is an existing rental building on site, the revised city guideline requires rental replacement or a portion of the units in the new building dedicated for rental purposes.

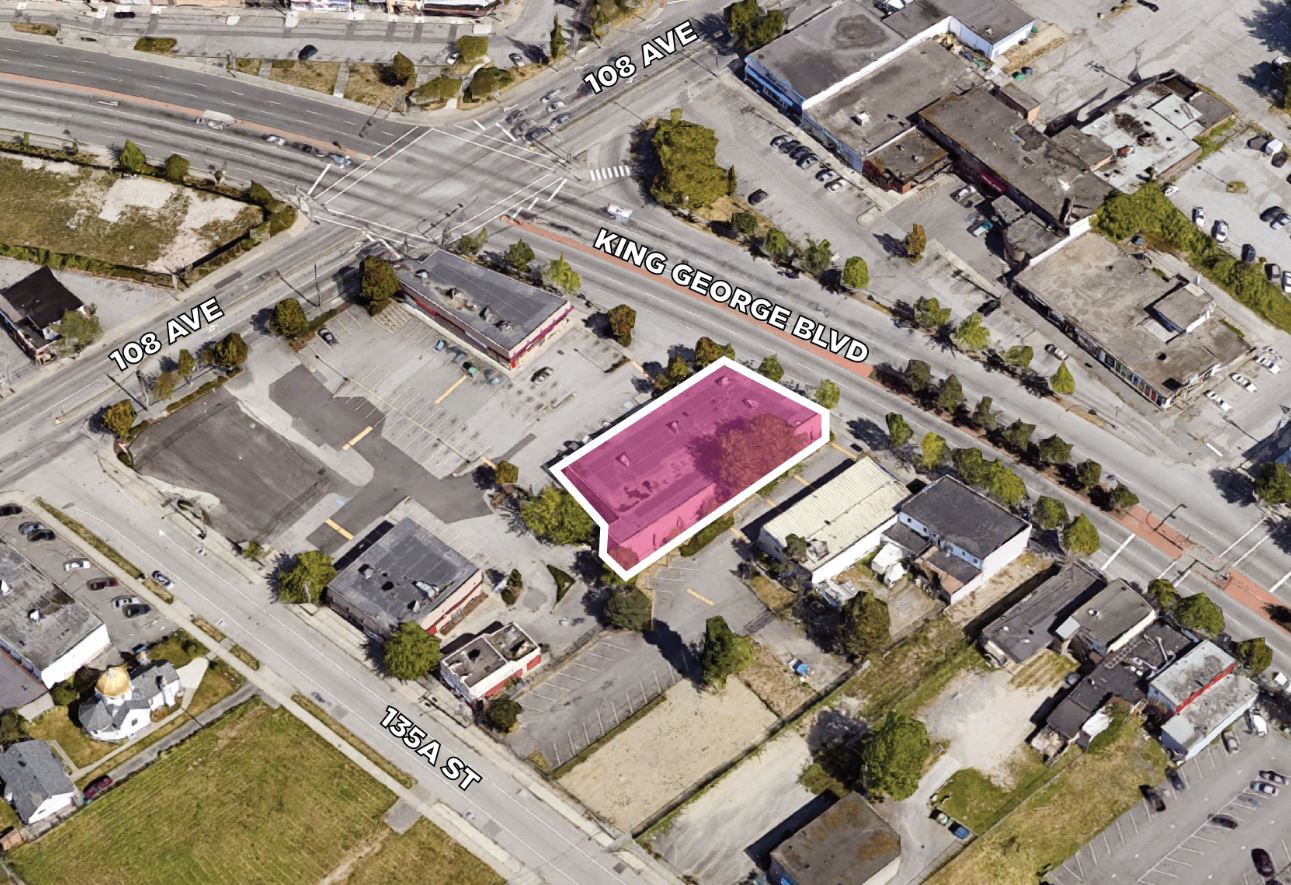

No 6. 10753-10761 King George Boulevard, Surrey

- Potential Development: Mixed-use High Density

- Price: $26,888,000

- Lot Size: 81,762 Sq.ft

- Land Price/Sq.ft: $329

- FAR: 5.5

- Price/Buildable Sq.ft: $60

- Vendor: Private Investor

- Purchaser: Tien Sher Group of Companies, https://tiensher.com/

Just as we had previously discussed: expanding outside Vancouver municipality in the Coquitlam deal; Surrey is another rapidly growing city; a new skytrain expansion; mass densification at skytrain station; and a newly approved recreational center for sporting activities. The site is located near Gateway Skytrain Station, a main transit connector hub in Surrey. A development proposal (0019-0367) was submitted to the City of Surrey to rezone from Mixed-use 3.5 FAR to Mixed-use 5.5 FAR. A 2 FAR improvement will allow 243,485 sq.ft of commercial/office space and 501 residential units. An interesting part regarding this deal is the 243,485 Sq.ft of office and commercial space. Will the Gateway neighbourhood be Surrey’s new business hub?

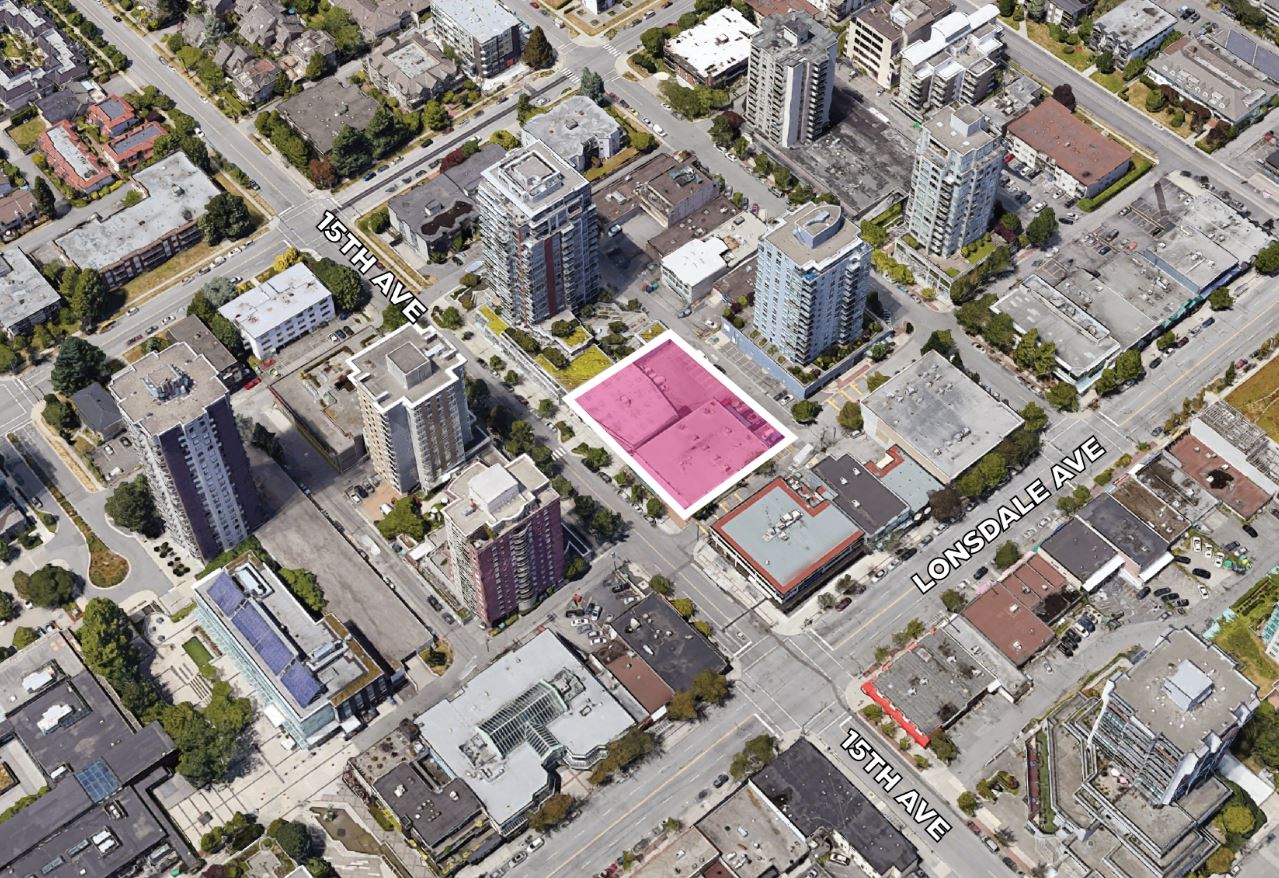

No 7. 114-132 West 15th Street, North Vancouver

- Potential Development: Mixed-use High Density

- Price: $25,500,000

- Lot Size: 25,221 Sq.ft

- Land Price/Sq.ft: $1,011

- FSR: 3.0

- Price/Buildable Sq.ft: $337

- Vendor: Private Investor

- Purchaser: Polygon Homes, https://www.polyhomes.com/

The site is located in the North Lonsdale neighbourhood within the city of North Vancouver. The existing improvement is a two-storey commercial building. The site is expected to be redeveloped by Polygon Homes. The site has the potential for a Mixed-use high-density building outlined in the North Vancouver Official Community Plan. There is no development application submitted at this given time. The development could be higher than the 68-metre restriction and the 3.0 FSR is kind of low for a mixed-use high-density development. It will be exciting to see how this neighbourhood gets planned out next year.

No 8. 18478-18504 80th Avenue, Surrey

- Potential Development: Low Density Cluster

- Price: $24,000,000

- Lot Size: 833,302 Sq.ft

- Land Price/Sq.ft: $29

- FSR: TBD

- Vendor: Private Investor

- Purchaser: Mitchell Group, http://www.mitchellgroup.ca/

It is an interesting site to make it into the top 10 land transaction ranking. It sold double the assessment value and the site is in the suburbs. Existing improvements include two single family detached homes and farm related buildings. This is a comprehensively planned site intended for a Low Density Cluster. It is zoned for general agricultural land. This begs an answer to the question of what the purchaser is planning for this site. It is very difficult to change ALR zoning and it will likely be a single house subdivision or townhomes.

No 9. 10662 King George Boulevard, Surrey

- Potential Development: Mixed-use High Density

- Price: $22,000,000

- Lot Size: 102,497 Sq.ft

- Land Price/Sq.ft: $215

- FSR: 7.5

- Price/Buildable Sq.ft: $29

- Vendor: Private Investor

- Purchaser: Northwest Development, http://northwestdevelopment.ca/

Northwest Development has purchased the parcels along with the development proposal (7919-0372-00) to rezone to comprehensive development (CD) to achieve a density increase. The proposed amendment is requesting the City of Surrey to permit a mixed-use 7.5 FAR development consisting of 979 residential units and 17,653 sq.ft of commercial space. The project is still in its initial review stage. This is one of the largest residential unit count projects proposed this year. Given the size of the land, it will likely be multiple high-density buildings with commercial at ground. It is also another site in the Gateway Skytrain Station Vicinity. If the proposal is passed, we will likely see a possibility of Gateway Station becoming or even overtaking Surrey Central in the next 10 to 15 years.

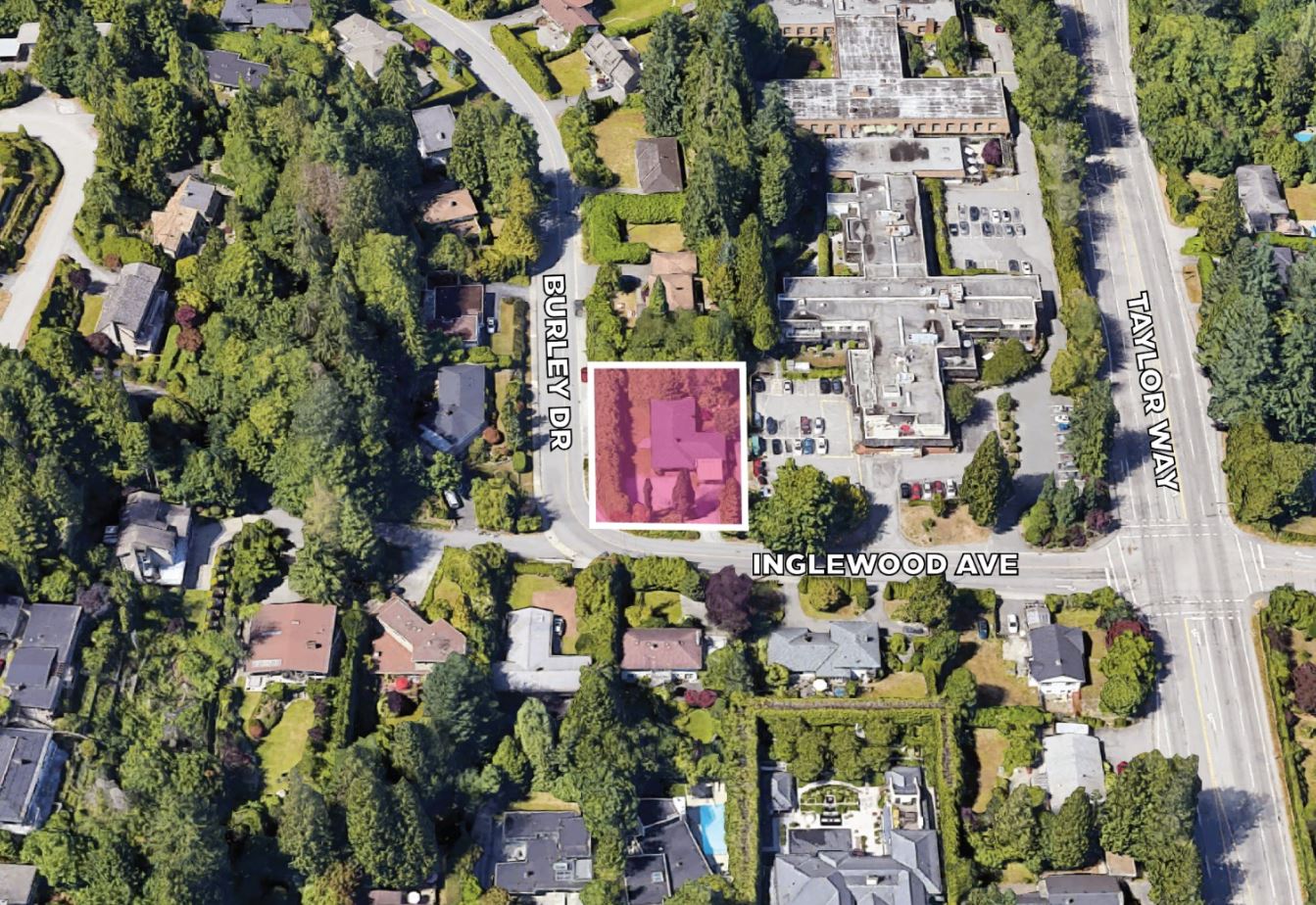

No 10. 721-733 Burley Drive, West Vancouver

- Potential Development: Low-Mid Density

- Price: $21,121,650

- Lot Size: 41,382 Sq.ft

- Land Price/Sq.ft: $510

- FSR: TBD

- Vendor: Private Investor

- Purchaser: Baptist Housing Oak Bay Care Society, https://www.baptisthousing.org/

The final deal that made it into the top 10 based on transaction price is three parcels designated for retirement use. Baptist Housing Oak Bay Care Society purchased from Inglewood Private Hospital. We believe that the lots will be redeveloped into retirement or social housing for the aging population.

The total transaction value of the top 10 residential redevelopment land value is $362 million dollars in 2020 compared to $502 million dollars in 2019, a 38% decrease. Majority of the top 10 deals were in the city center urban core.

>>Top 10 (ICI) industrial, Commercial and Investment Real Estate Deals in 2020<<